Your 50s are a great time to explore life insurance options. There are many mainstream and specialist products available to you in this age bracket. So whether you have dependents you're worried about or you wish to leave a cash sum for your beneficiaries, there will be options available to you.

But it can be a tough choice to make. The older you are, the more expensive it becomes to take out a policy as your risk increases. In some cases, the premiums become so costly that it no longer makes sense to take out a policy at all. The expected payout would be lower than the sum of your premiums, so you might be better off just saving your money or investing them elsewhere. It might also be worth considering alternatives to life insurance cover, such as a funeral plan. However, some life insurance policies will come with a funeral benefit option.

Whatever you need, there are options to explore. And once you turn 50, you qualify for specialist policies tailored to your age. These policies do not require medical underwriting, and acceptance is guaranteed. Pre-existing conditions won't stop you from getting a policy, and you will get a payout as long as you pay your premiums and stick to your policy's terms and conditions.

If in doubt, consider consulting a financial adviser who can provide professional guidance on the best path to take.

How does over-50s life insurance work?

Most over-50s life insurance policies are available to people between the ages of 50 and 80. This means you must take out a policy before your 80th birthday if you wish to benefit from this product.

However, if you take out an over-50s life insurance policy before turning 80, you will be insured for the rest of your life. This is a type of whole-of-life insurance policy.

As long as you pay your monthly premiums and meet your policy's terms and conditions, your loved ones will receive a cash payout on your death. This is sum assured, meaning your beneficiaries will get a fixed sum that you select when you take out your policy.

What kind of payout can I expect from over 50s life cover?

You have some control over the lump sum your family will receive when you take out a policy. However, the higher the lump sum you require, the higher your premiums are likely to be as well.

You should think about what you want your family to do with the money when you die. For example, do you want your over 50s life insurance payout to cover the cost of your funeral? Pay any outstanding debts? Give your beneficiaries an inheritance? All these factors will influence your decision.

You must also consider how much you want - or can afford - to pay per month before you make this commitment. Remember, most policies will expect you to keep paying until you turn 90 or until you die. If you miss any payments, you may lose your policy altogether.

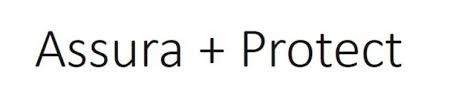

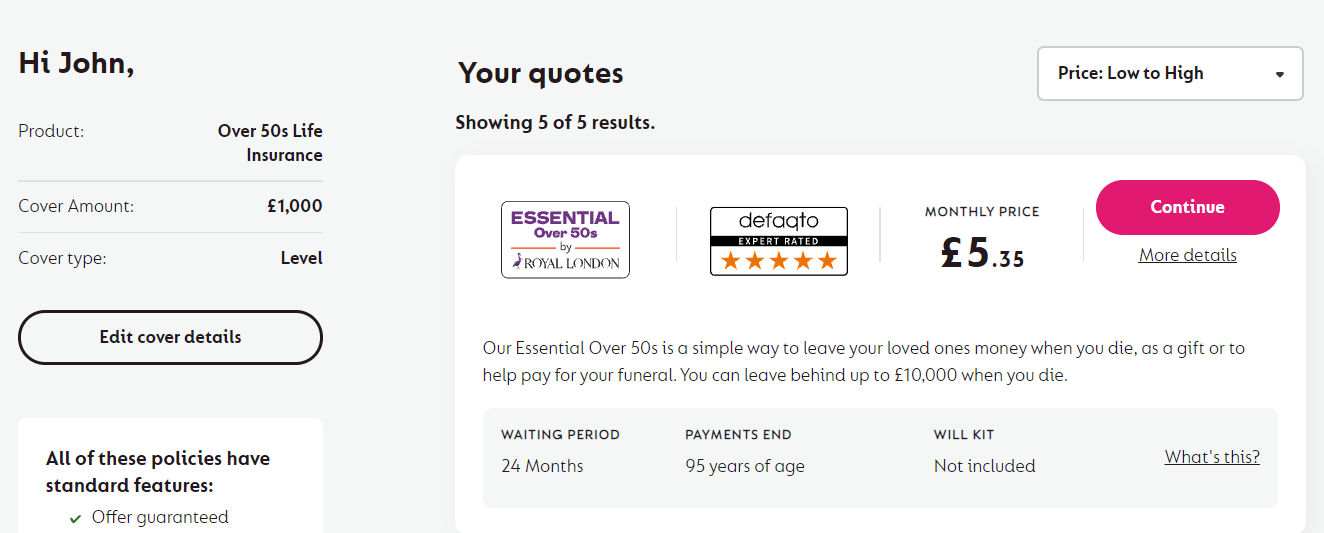

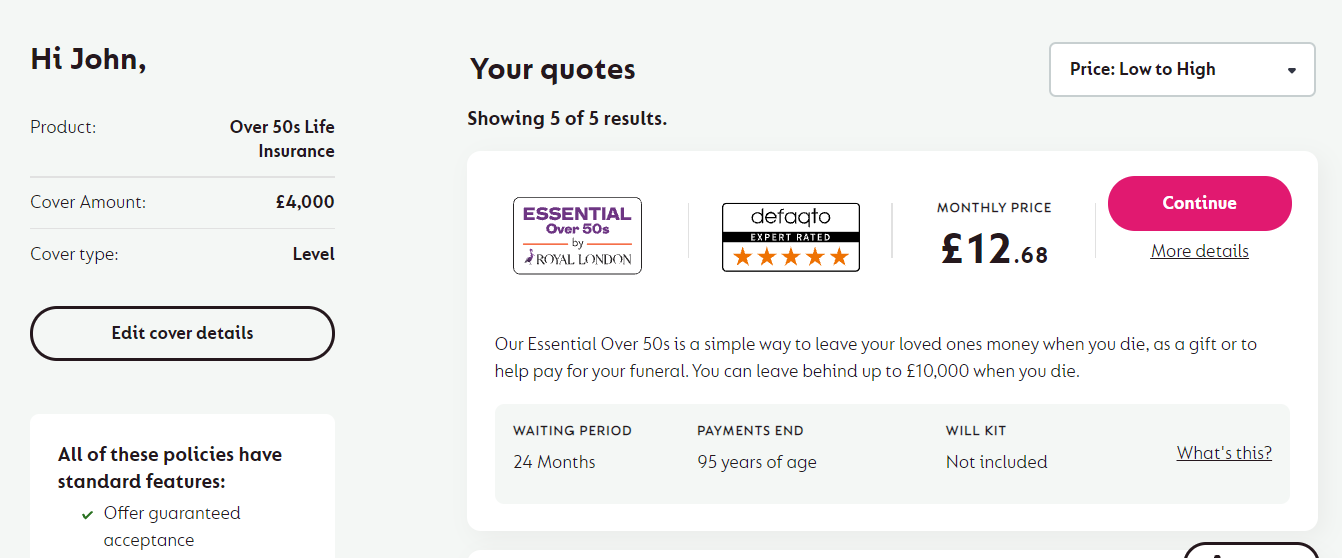

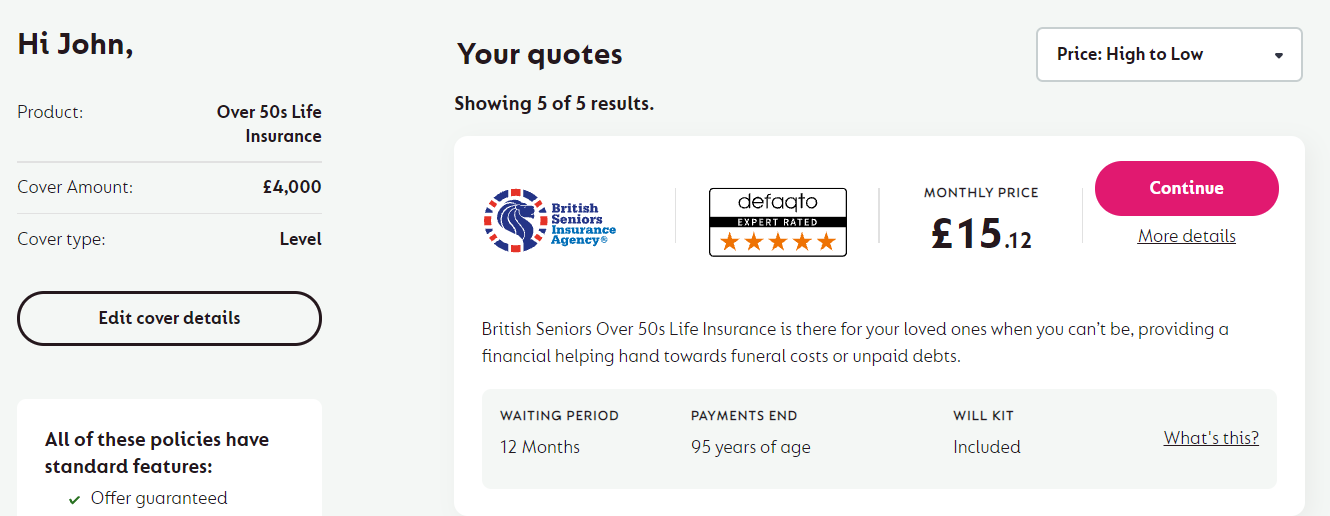

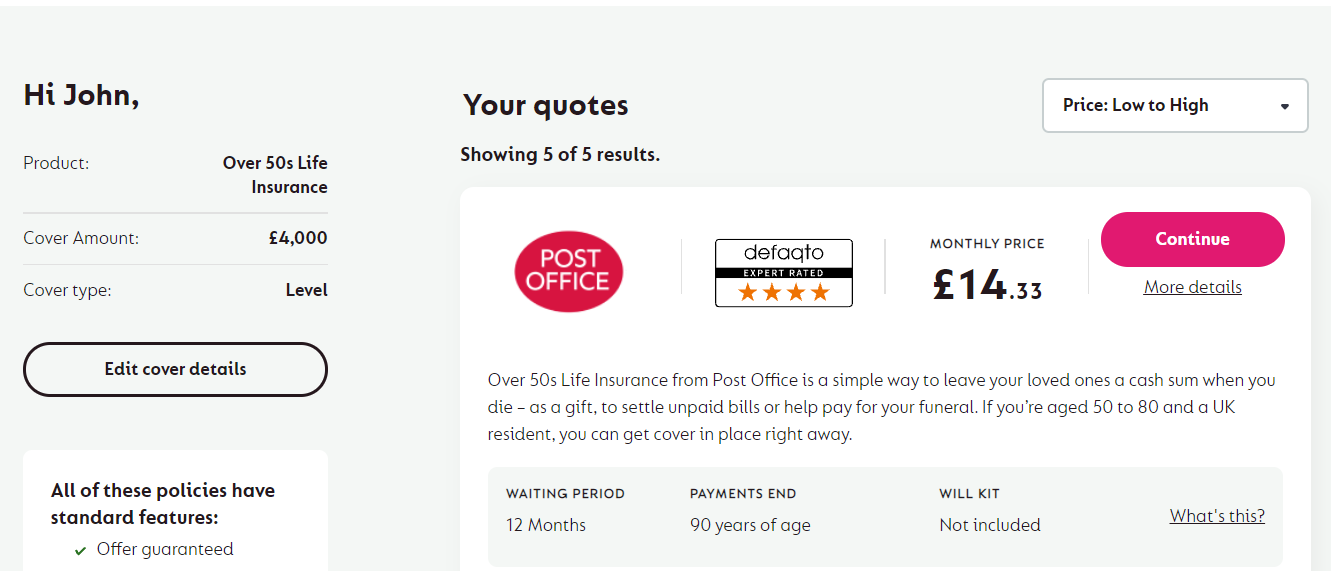

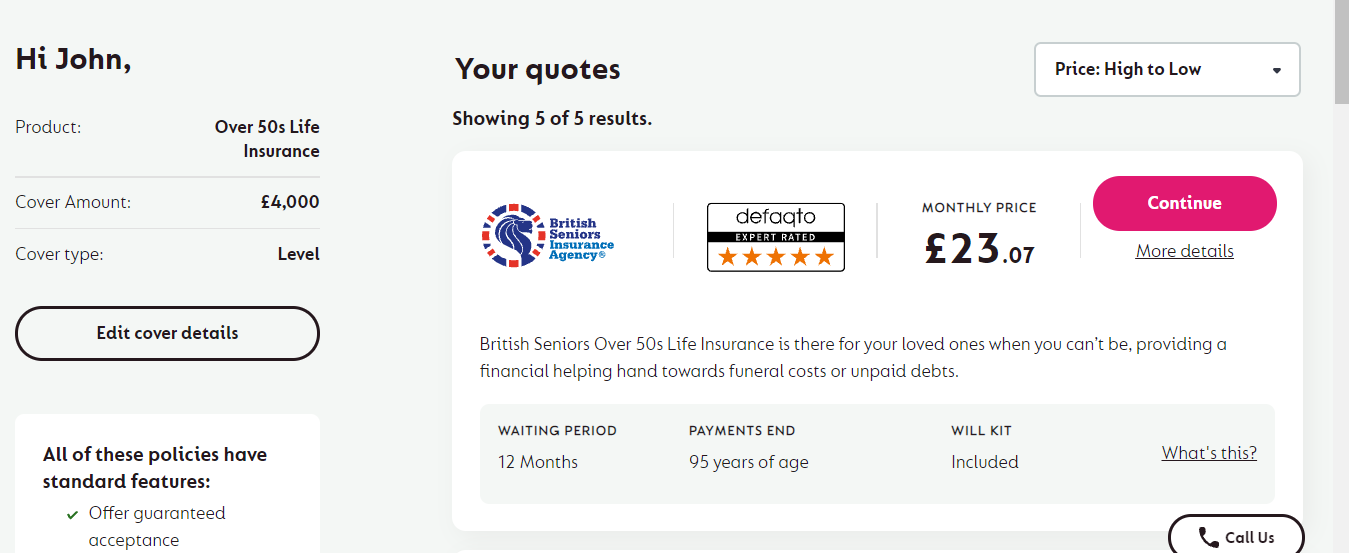

We created a fictitious 51-year-old man, John Smith, to see how different payouts would change his premium.

While over-50s life insurance does not require a medical test to obtain a policy, there was still one lifestyle question to answer. Insurers wanted to know whether Mr Smith was a smoker or not.

Below, we will see the impact on his policy premiums for the different payouts he required.

Comparing over 50s life insurance quotes

Premiums for a £1,000 over-50s life insurance payout

Let's say Mr Smith only wants to insure himself for the minimum amount of £1,000. A 51-year-old non-smoker would need to pay £3.99 per month for the cheapest available policy. Mr Smith would need to pay this until he turns 95 to receive the £1,000 payout on his death. Unless his death is the result of an accident, his dependents won't be able to claim a payout in the first 24 months of cover. Some life insurance providers will have a standard 12-month waiting period, meaning they won't pay out in the first year of cover outside of accidents, so ensure you check your policy documents and T&Cs.

If Mr Smith lives beyond 71, he will have paid more into this policy than his dependents would receive when he dies.

The most expensive policy available would see Mr Smith with monthly payments of £10 per month. This policy comes with terminal illness cover, which means he can claim his payout before he dies in the event of being diagnosed with a terminal illness. But if Mr Smith lives another eight years without getting terminally ill, he will end up paying more into the policy than he would receive.

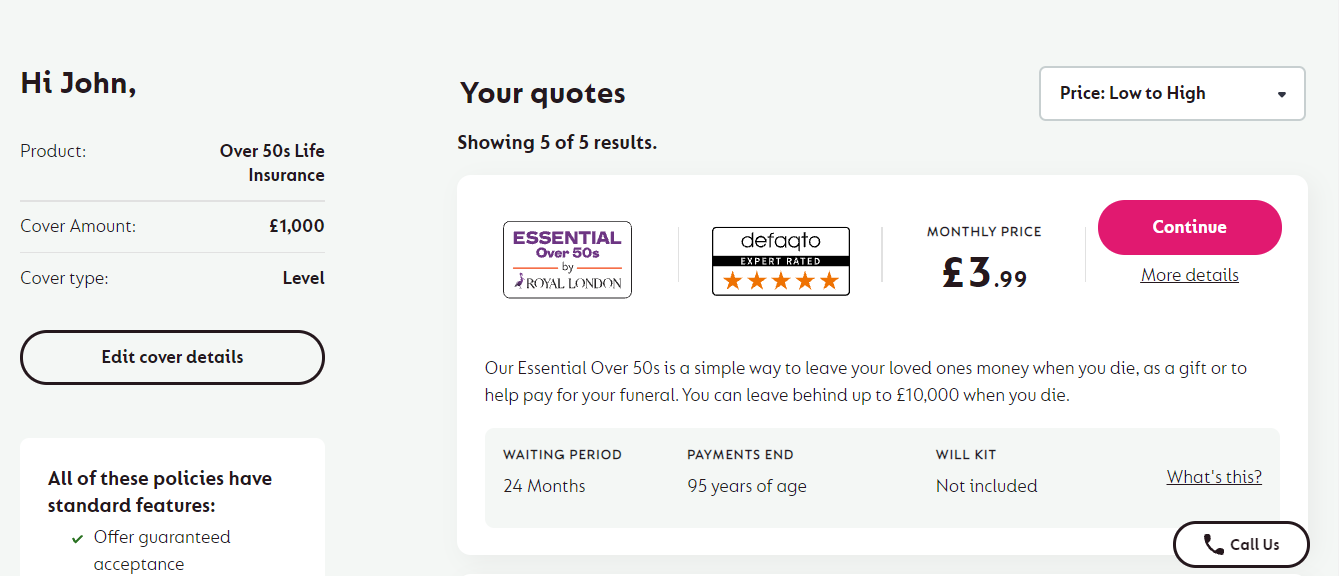

If Mr Smith is a smoker, his cheapest policy option would now cost around £5 per month, while his most expensive policy would still be £10 per month. This represents a slight extra cost, illustrating that while smoking does not preclude you from taking out life insurance, it is screened despite you not needing to answer any other health questions and could increase your premium.

Premiums for a £4,000 over-50s life insurance payout

If Mr Smith wants a mid-range payout of about £4,000, his monthly premiums will go up. Assuming Mr Smith isn't a smoker, he can expect to pay an average cost of between £12 and £15 per month for a policy that would pay out £4,000 on his death.

It would take Mr Smith approximately 22 years to save this amount if he saved £15 per month into his own savings account. If Mr Smith is in relatively good health and believes he has a good chance of living past the age of 73, he could end up paying more in premiums than the expected payout.

As with the above policies, Mr Smith would need to pay into his policy until he turns 95 or dies, whichever comes first.

But what if Mr Smith is a smoker? His premiums now range from £14 to £24 per month. So his contributions could double as compared to the non-smoking prices depending on the policy he chooses.

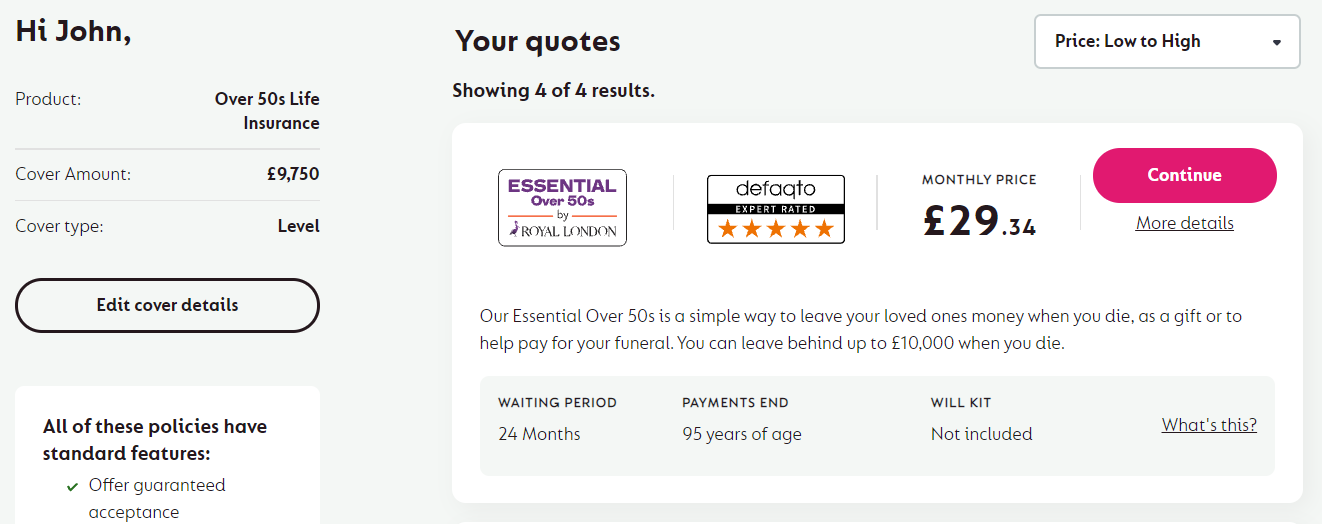

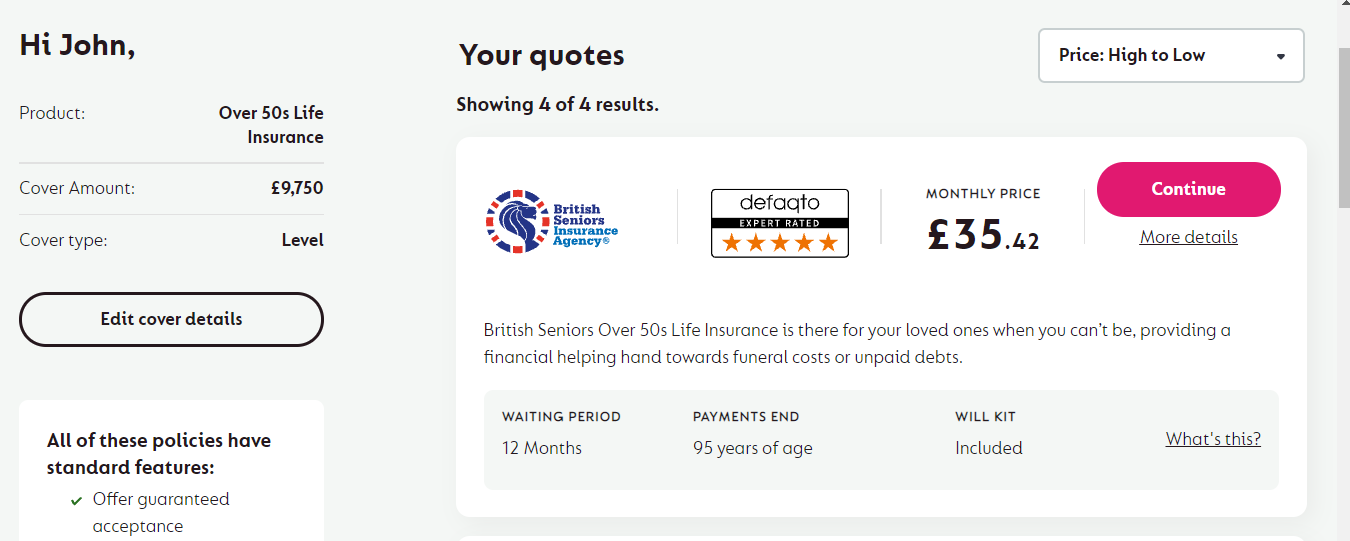

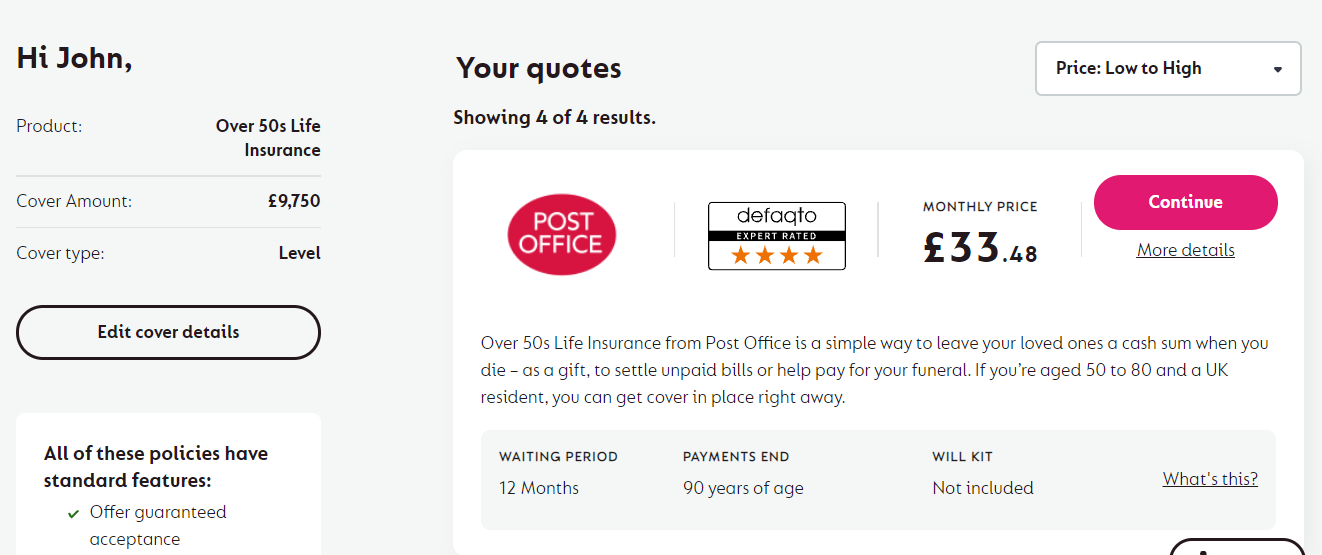

Premiums for a £9,750 over-50s life insurance payout

Perhaps Mr Smith wants to give his loved ones the biggest payout possible so they can cover funeral costs and have a little leftover for themselves, too. He opts for the £9,750 payout available via GoCompare.

Now, Mr Smith is looking at premiums ranging from £29 to £36 per month until he turns 95.

If Mr Smith put away £35 in his own savings account instead, it would take him around 23 years to save up £9,750. If Mr Smith lives to 74, he will have paid the same amount into his policy as his eventual payout. But Mr Smith will need to continue paying into his policy until he dies or turns 95 if he wishes to receive the eventual payout.

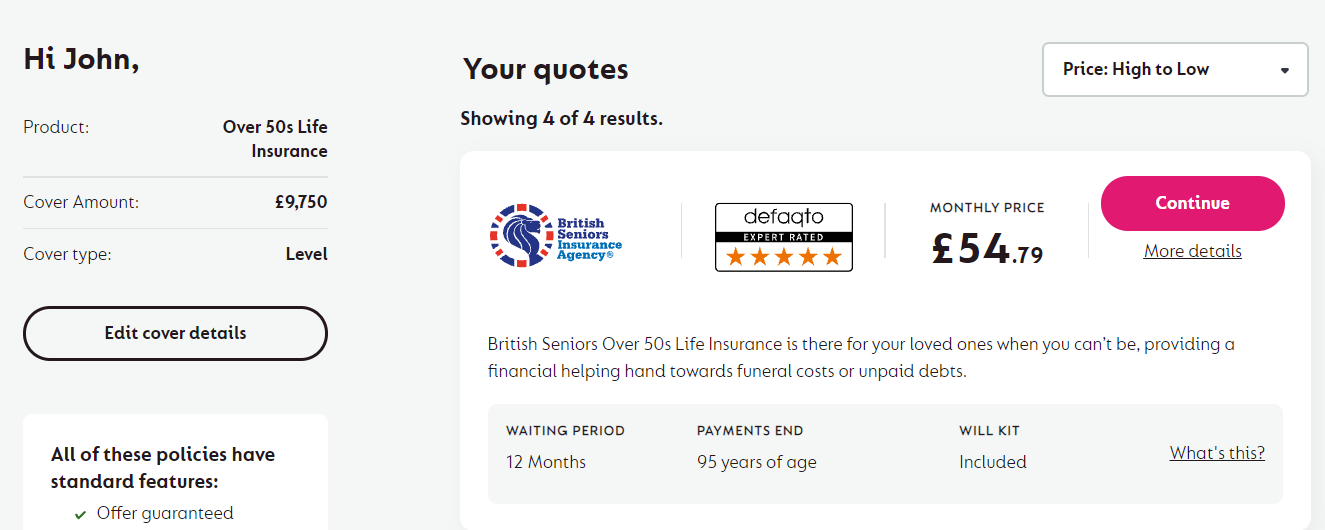

If Mr Smith is a smoker who wants to get the largest payout available, he can expect to pay anywhere between £34 and £55 per month in premiums until he turns 95. Mr Smith would need to save £55 per month for roughly 14 years to reach this amount if he were saving into an ordinary savings account.

What do these figures mean?

Pitching the figures above against the current life expectancy in the UK could lead you to believe that these policies do not represent good value for money. Men and women in the UK in their 50s could expect to live at least another 30 years. According to the latest data, life expectancy for a 51-year-old man is around 81. A 51-year-old woman in the UK can expect to live to 84.

But insurance isn't all about averages. Your circumstances matter. Do you have any underlying health conditions that could limit your lifespan? Do your lifestyle choices mean you could live a shorter life than average?

Finally, life happens. These insurance policies pay out in the event of accidental death from the moment you take them out in most cases. If you are concerned about what would happen to your loved ones in the event of an accident, you might want to look into over-50s life insurance. After all, you're paying for the peace of mind the policy provides as well as the product itself. A life insurance policy could be well worth it in some cases.

Whether you want to help your family cover your funeral expenses or grant them an inheritance, it's vital to get the full cover you need for your circumstances.

How does over-50s life insurance compare to other types of life insurance?

You could still take out generic life insurance products when you're in your 50s. Premiums will be higher, and the payouts will generally only be valid for a fixed term, but this could be another option to consider depending on your needs.

Term life insurance policies will have higher payouts than over-50s life insurance. Here are some ways in which these policies differ from over-50s life insurance:

- Usually medically underwritten

- Acceptance is not guaranteed

- Will only payout if you die within a specific term, i.e. 20 years

- Most insurers will not cover you after you turn 85, so the term will end then

Whatever type of life insurance product you opt for, make sure you read your policy summary, so you're clear on the cover you have.

If you're in your 50s, a non-smoker, and in relatively good health, you could expect to pay around £30 per month for insurance that will cover you for 30 years and will provide your loved ones with a £100,000 payout when you die.

This could work well if you are only looking for insurance options that would cover a specific period of your life, i.e. if you have children who will become independent eventually or a mortgage that you will have paid off in the next 30 years.

You can find out more about this type of insurance here if it is of interest.

Is over-50s life insurance worth it?

Over-50s life insurance could be a great choice if you do not have another life insurance policy already or have underlying health conditions that are potentially life-limiting. This type of health insurance does not require medical tests and guarantees acceptance. Your loved ones will receive a pre-determined payout as long as you keep up with your premiums.

However, if you're in relatively good health and expect to live a long life, you might find that you will be paying into a policy that will cost a lot more than the eventual payout your loved ones will receive. This is especially true when you consider inflation. The fixed sum your loved ones receive will dwindle with the years due to inflation.

Nevertheless, life insurance could be a great way to give yourself some peace of mind and ensure your loved ones are looked after when you die.