This article is adapted from https://www.netwealth.com/ourviews/why-we-launched-mynetwealth-and-how-it-can-transform-financial-lives/ and is republished by Pension Times with permission from Netwealth.

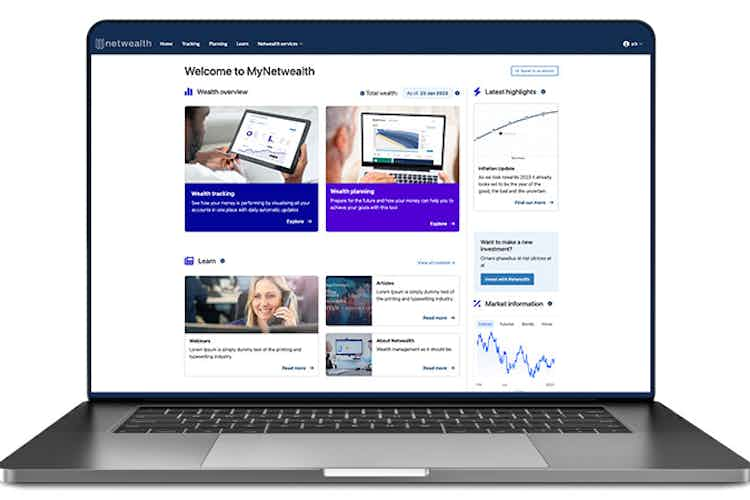

Having all the right information is key to building a successful financial plan for the future. However, the challenges of obtaining this information is why Netwealth set up MyNetwealth – a unique service in the UK to help investors track all their investments in one place and make informed planning decisions around their wealth and what it can do for them.

We all need more clarity when it comes to our finances

The uncertainty caused by the pandemic, the war in Ukraine and high inflation has made it especially tricky for investors to plan ahead with confidence. Conflicting media commentary and excessive market noise hasn’t made it any easier.

Keeping track of different savings and investments, from diverse providers, is often all but impossible under normal circumstances, even with some form of personal list or spreadsheet to understand your total wealth.

And these records typically lack two powerful features: the ability to track the value of assets over time and the sophistication to project wealth forward and relate it to what you want to achieve in the future.

Gaining greater visibility and control

MyNetwealth solves the dual issues of tracking all your wealth daily, and seeing whether its projected growth is sufficient for your future plans.

Register at MyNetwealth.com to track your investments and their changing values, regardless of provider, via the Wealth Tracker.

You also benefit from a more comprehensive overview. For instance, the Wealth Tracker lets you see the total percentage you have invested in each asset class across all your accounts, so you can check whether your overall allocations are as you would want them. You can also see the breakdown by account type, eg, the splits between ISAs, pensions and general investment accounts.

The Wealth Planner can then be used to provide a detailed personalised projection of your wealth through time and your likely income in retirement – in just a few minutes.

This much-needed service is designed for how we live today: aimed at time-poor individuals who value accessible, accurate and up-to-date information about their holdings so they can make better decisions about their futures.

MyNetwealth also helps investors to be better informed through free webinars and articles in its Learn section – with personal finance, market and economic analysis from the Netwealth team of specialists.

In addition, Netwealth is offering the option of a low cost ‘financial planning MOT’ with one of its advisers. This may suit those who are not seeking full-blown regulated advice but would like to discuss their financial plans more formally.

An evolution of Netwealth’s wealth management service

MyNetwealth naturally adheres to Netwealth’s founding company principles: to use pioneering technology to give investors a better deal, with relevant choices, greater transparency and more control over their money.

And it can also complement any other investment or wealth management service you may already use. If your overall investment position is a little hazy now, and you would value having a clearer view of your finances, try out this free service and see the difference it could make.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. The company does not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.